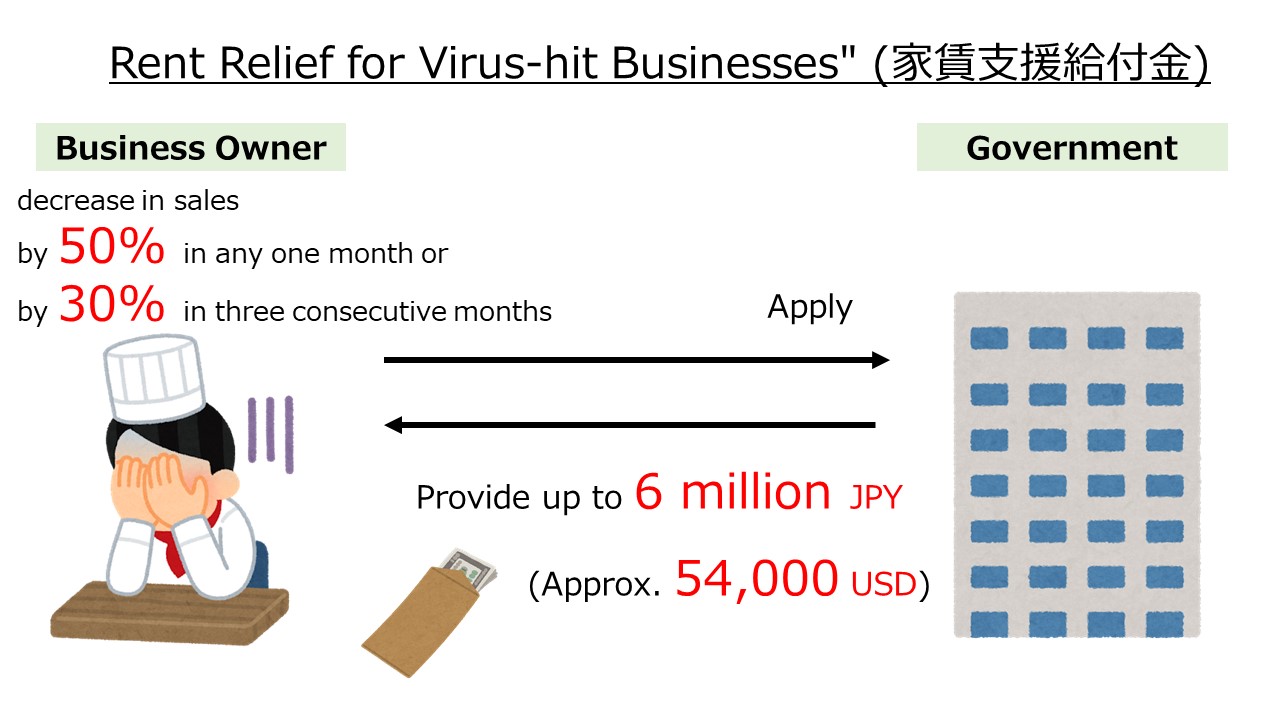

Up to 6 Million JPY! (Approx. 54,000 USD)! How to Apply for the July 14th, “Rent Relief for Virus-hit Businesses” (家賃支援給付金)

July 15th 2020

In order to support business continuity in the midst of the emergency measures etc. started in May against the novel coronavirus, the Japan government has started an additional subsidy program, effective as of July 14th, that will supply benefits to tenant businesses such as restaurants that have to pay rent even though their sales have seen a sharp decline.

As small and medium-sized businesses can receive up to 6 million JPY (approx. 54,000USD), and individual business operators can receive up to 3 million JPY (approx. 27,000USD), we strongly recommend making an application if you run a restaurant and have to pay rent.

Benefits are available to all small and medium-sized businesses, including restaurants and those run by individual business operators. The difference between the two is simply whether the business has been registered and is operating as a company (Kaisha, 会社), or as an individual business operator (Kojin-Jigyonushi, 個人事業主).

There are two conditions for small and medium-sized businesses or individual business operators to be eligible for benefits.

1.

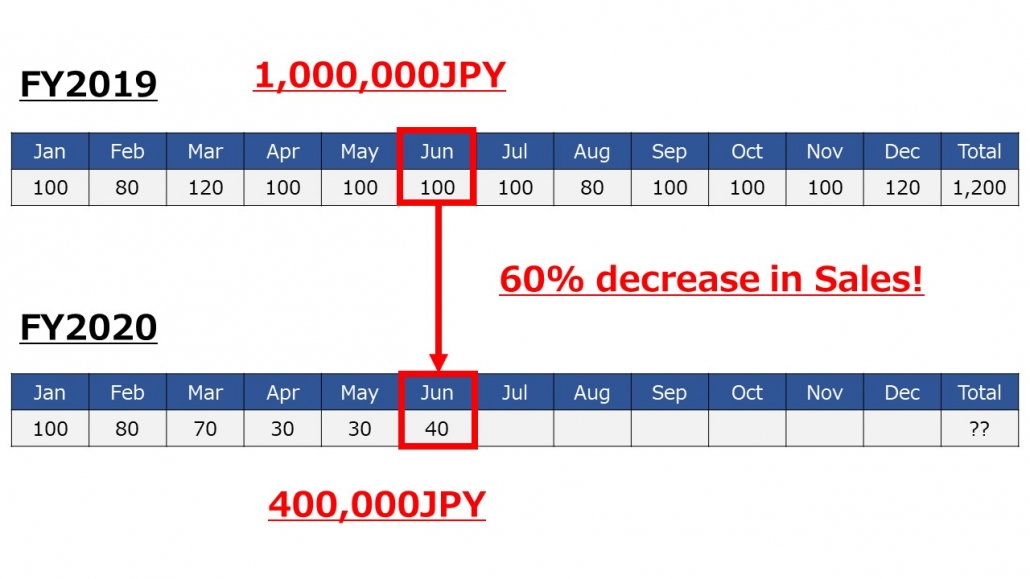

In the period from May to December 2020, in any one month they see a drop of 50% in sales compared to the same month in 2019.

For example, if a restaurant had sales of 1 million JPY in June 2019, but sales of only 400,000 JPY in June 2020, this would mean a 60% decrease, and the condition is met.

2.

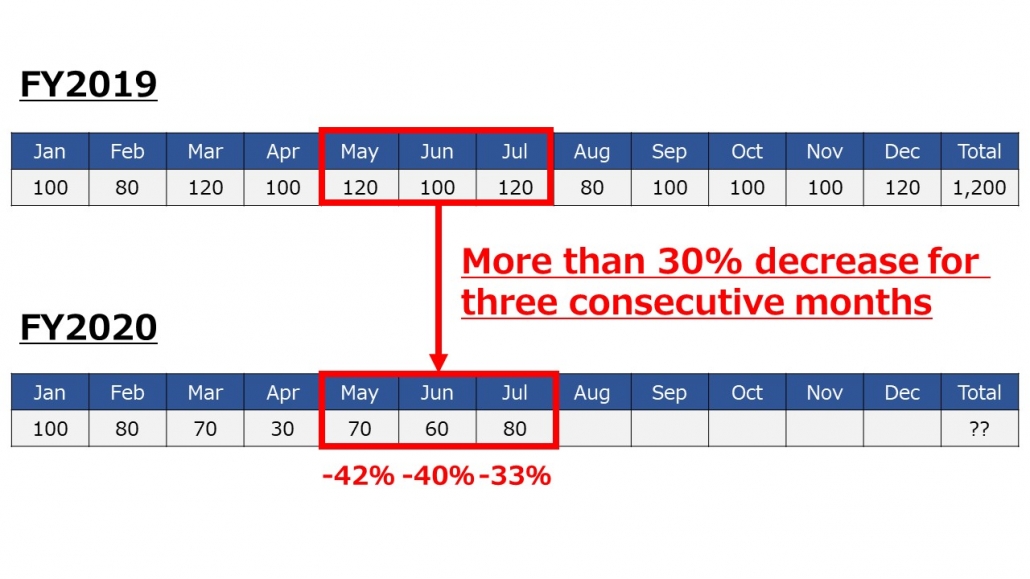

In the period from May to December 2020, they see a decrease in sales of more than 30% for 3 consecutive months (compared to 2019).

For example, if May-July 2019, sales were 1.2 million JPY, 1 million JPY, and 1.2 million JPY respectively, but May-July 2020 sales were 700,000 JPY, 600,000 JPY, and 800,000 JPY, then these three consecutive months saw a decreased of 30% or more compared to 2019.

Benefits and Calculation Method

Benefits are calculated according to the most recent month’s rent (at the time of application) times *6 (6 months’ worth). The maximum amount is different for companies and individual business operators.

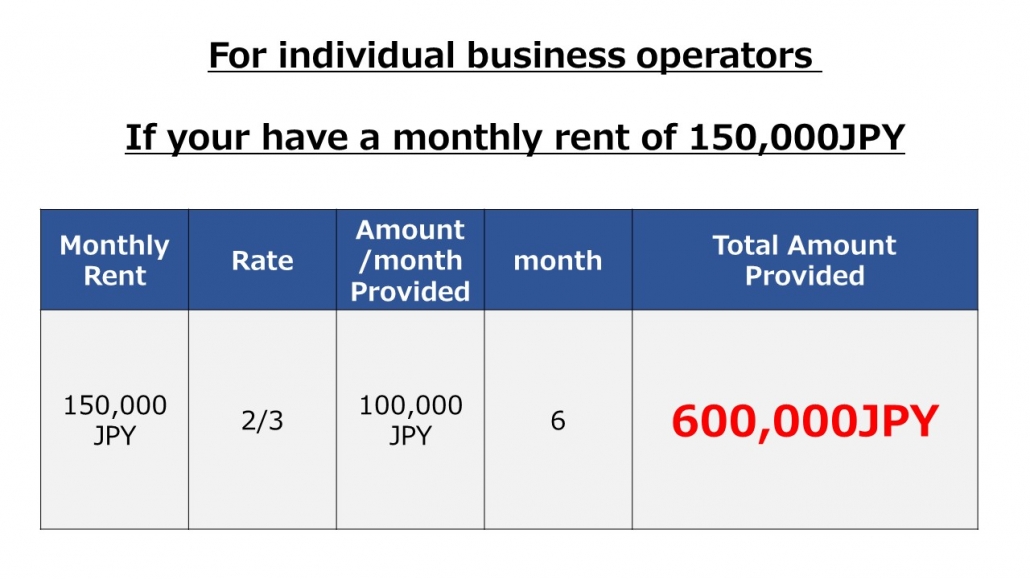

Individual business operators

The maximum amount is 500,000 JPY / month for individual business operators. Benefits are determined based on how much rent is paid.

For individual business operators when the rent is 375,000 JPY or less

If the monthly rent is 375,000 JPY or less, 2/3rds of the rent will be the amount provided.

For example, if a restaurant has a rent of 150,000 JPY, 2/3rds would be 100,000 JPY, times *6 (6 months’ worth) equaling 600,000 JPY.

For individual business operators when the rent is 375,000 yen or more

Up to 375,000 JPY, 2/3rds of the monthly rent will be provided, but for the amount of rent that is over 375,000 JPY, 1/3rd will be provided.

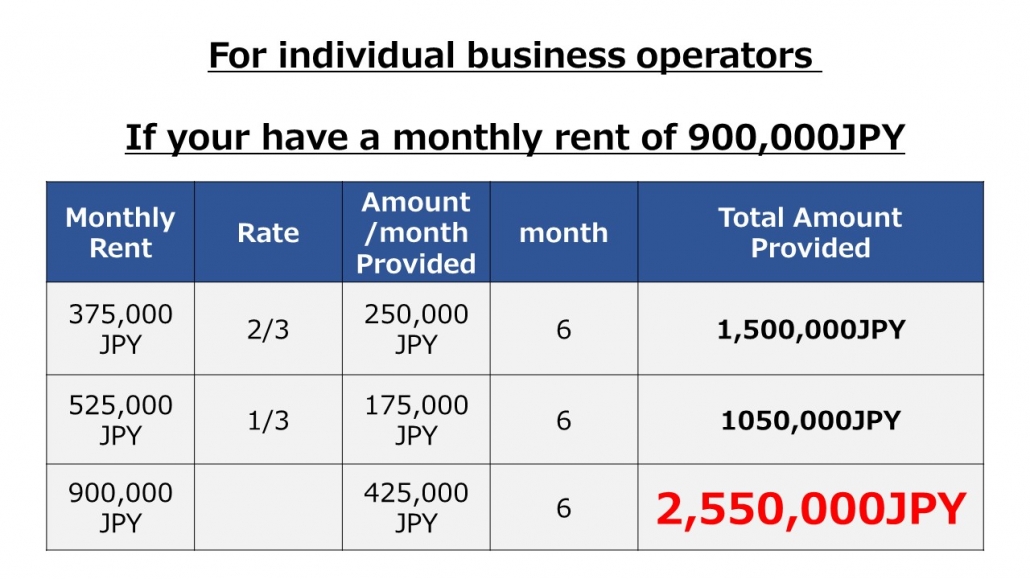

For example, if the rent is 900,000 JPY / month

375,000 x 2/3rds= 250,000

(900,000 – 375,000) x 1/3rd = 175,000

250,000 + 175,000 = 425,000 JPY / month

425,000 x 6 (months) equals 2.55 million JPY in benefits.

Companies (small and medium-sized business)

The maximum amount is 1 million JPY / month for companies. Benefits are determined based on how much rent is paid.

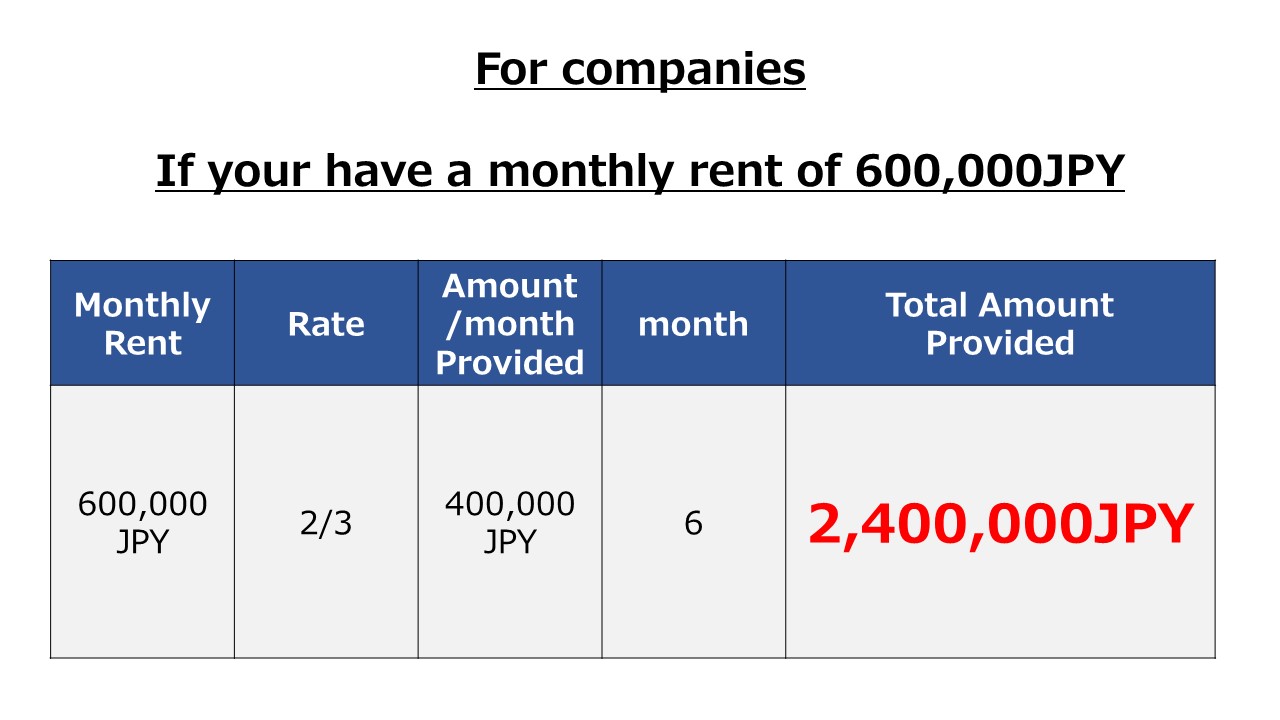

For companies when the rent is 750,000 JPY or less

If the monthly rent is 750,000 JPY or less, 2/3rds of the rent will be the provided.

For example, if a restaurant has rent of 600,000 JPY, 2/3rds of 600,000 yen is 400,000 JPY times *6 (6 months’ worth) equaling 2.4 million JPY.

For companies when the rent is 750,000 JPY or more

Up to 750,000 yen, 2/3rds of the monthly rent will be provided, but for the amount of rent that is over 750,000 yen, 1/3rd will be provided.

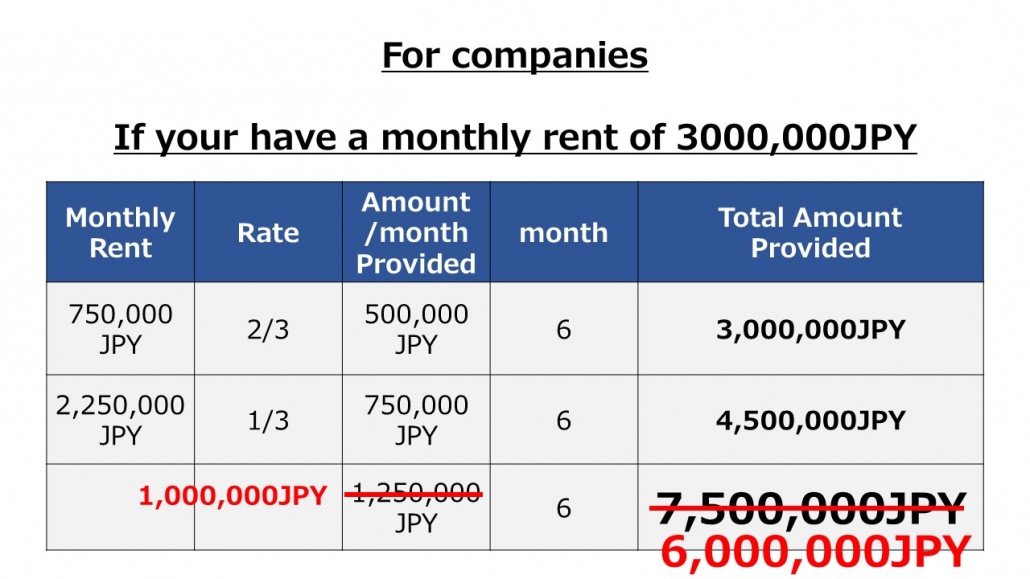

For example, if the monthly rent is 3 million JPY

750,000 x 2/3rds= 500,000

(3 million-750,000) × 1/3rd = 750,000

500,000 + 750,000 = 1,250,000 JPY / month

For companies, as the maximum amount is 1 million JPY,

1 million JPY x 6 (months) equals 6 million JPY in benefits.

What if the Company Owns Multiple Restaurants?

If one company owns multiple restaurants that pay rent, the total can be calculated for each restaurant and added together.

How to Apply for the Rent Relief for Virus-hit Businesses?

You can apply online through the website below, but as of July 2020, all the information on the website was written in Japanese. If you can’t read Japanese, please ask someone who can read Japanese for help with this.

Alternately, you can ask a certified administrative procedures specialist or certified tax accountant who is familiar with these kinds of benefit applications to do to it for a fee. Usually fees are about 5-10 % of the benefits if the application is successful.

What Documents are Needed?

The necessary documents are as follows.

For individual business operators

For small and medium-sized company owners

How Long Do You Need to wait?

If there are no problems with the application, the benefits will normally be paid to your bank account within about one month. Upon receiving these benefits, you must inform the property owner immediately and proceed with payment. These benefits can only be used for paying rent.

There are 26,000 foreigners staying in Japan with Business Owners visas. We’re not sure the number of foreigners registered as individual business operators, but a considerable number of people are doing business while paying taxes in Japan. There are many people who don’t yet know about this benefit program, so be sure to tell your friends.

Feel free to ask us contact about this program if you need a help.

What would you like to know more?

Culinary Schools in Japan

Tokyo Sushi Academy

The first and the most popular sushi school in the world.

Japan Culinary Institute

Japanese culinary training including sushi, kaiseki, yakitori, wagashi and more.

Miyajima Ramen School

More than 1,000 graduates from over 50 countries.

International Ramen School

Ramen study program combined with OJT